Suggestion to Help Drive Mass Adoption of Pay by Touch Online by Building a Better “Mouse”trap

Yesterday, Digital Transactions Magazine suggested that Pay by Touch “may face a hurdle when it comes to getting consumers to acquire and hook up finger scanners. It says “consumer adoption of peripheral devices has lagged with other authentication and payment programs.”

Today, IT Week in the UK said: Pay By Touch, has launched an online version of its fingerprint reading service. However, there is a need for an external device, the fingerprint reader- which could be a barrierto-adoption.

And Internet Retailer reported today that: “To use the online service, consumers must purchase a finger sensor from the Pay By Touch web site or from Pay By Touch partners, such as Internet merchants and financial institutions", says Jon Siegal, executive vice president of Pay by Touch Online. "Finger sensors will cost less than $30". Editor's Note: (inserted October 4th, 2007) Anybody still wonder why he's gone...

Although I agree that consumer adoption of peripheral devices has lagged, (as there are many documented examples), I would suggest that the reason it happens is because; in those cases, there was a requirement for an “additional” peripheral device. An additional device requires an available USB port, which sometimes people don’t have available. It also requires installation and additional space on the desktop. These requirements will diminish adoption levels. As you know, people purchase items because they “want” them or, to a lesser extent, because they “need” them.

If a PC user could simply replace their existing “older” peripheral device with a “brand new superior” device the adoption hurdles may well be alleviated. PBT could therefore; simply offer a higher quality replacement for a device the consumer already has, needs and uses…their mouse.

The PBT biometric “mouse” would not require an additional port, it’s easy to hook up, it doesn’t take up additional desk space, and it will include a biometric sensor for more secure and convenient online banking and online shopping. Now we’ve got a potential recipe for success.

The replacement of anything old with anything new, happens more frequently in the field of technology than anywhere else…especially when advanced features and ease of use are involved. It is a natural psychological fit, because we want the consumer to “replace” the way they currently purchase online with Pay by Touch, not just add PBT as another “optional” payment choice. If it came from a well-known manufacturer, Microsoft for example, then brand association would help with mass adoption. The alternative is providing it on an OEM basis, emblazoned with the PBT logo, resulting in better branding for PBT. Personally, I’d go the OEM/PBT logo route, as it essentially puts our name and logo in front of the user 24/7/365, or every time they use their PC.

The end result is that instead of Pay by Touch selling a finger scanner for $30, we’d be offering a better alternative to their existing mouse. This new bio-mouse would be wanted not only because it’s brand new, but also because it upgrades their existing old peripheral with a new dynamic...a biometric sensor.

A mouse with the PBT biometric sensor would help alleviate fears and provide “peace of mind” by enhancing security when transacting online. It could also be used to securely sign in thus alleviating the need for passwords.

There also exists, a powerful turnkey natural distribution system, with over 34 million+ “captured” customers, and 66 million "captive" users, but more on that in a minute.

A Biometric Mouse could be OEM’d by PBT and distributed via banks to secure and procure online banking customers and create PBT enrollees. What if Pay by Touch (via a distributor) offered to make this upgraded more technologically advanced, biometric mouse, available for “FREE”? What? Did I just say the “F” word? Yes, I apologize but hear me out; I’m trying to drive adoption here.

This may sound like it would be capital intensive but it isn't. There is a very cost effective, and resourceful way for Pay by Touch to accomplish this.

First: Identify the target market. I’m suggesting it is the online banking customer. Currently there are 35 million (and growing) online banking consumers, most of whom have concerns regarding online security. Biometrics can appease those concerns.

Second: Identify the target distribution method. Obviously, it is their banks because that's who consumers already with their money. Consumers are more apt to follow the suggestion of a trusted source and banks are that “trusted source.”

Potential Problem: Usually distributors need to have some sales acumen, and banks aren't known for that.

Potential Problem Solved: Banks overcome this disadvantage because they already have established, inherent trust. Two of the most important goals in sales are to establish trust and overcome the unspoken objection.

The unspoken objection when you give away something free, is: “There must be a catch” and “There's no such thing as a free lunch.”

Banks however, naturally overcome that objection because they have been giving away things for free since the beginning of time. It's the only way they know how to sell. Instead of toasters, microwaves, radios, etc., why not a free Pay by Touch Biometric Mouse when their existing customer signs up for their new improved, more secure online banking program.

The task at hand now becomes: How can Pay by Touch convince Banks to become “very enthusiastic” distributors of a device that costs them $30 a pop?

Here’s five ways:

First, point out that the bank would benefit economically by eliminating the IT costs associated with e-mailing “username /password,” reminders or costs associated with resetting them every time there is a suspected breach... a cost that has been estimated to average around $150 annually per user.

Secondly, the bank would surely enhance their image by introducing a whole new “safer” online banking experience/platform amid consumer fears regarding online banking.

Third, there is more loyalty from online banking customers. Forrester Research reports that online banking customers are 40% more likely to stay with their institution.

Fourth, Biometrics from PBT would increase the potential number of that bank's customers who would sign up for their online bill payment as it would be safer and more convenient.

Finally, Pay by Touch could point out that; it would cost the bank essentially nothing and simultaneously provide a tremendous value in return. Here's why it would cost the bank essentially nothing to give these away free.

a: By eliminating a user that costs $150 per year and replacing them with one that doesn't, the $30 investment results in a $120 return on investment…the first year alone.

b: The bank could write off the cost of the mouse ($30), as an “advertising” expense instead of the $150 as an “operating” expense, and it would be advertising money better spent than normal advertising, because it would target a specific “profitable” niche.

Consequently, the bank’s customers would benefit from increased convenience and peace of mind. PBT could help position the bank to convert the customer into an Online Banking AND Bill Payment user and Pay by Touch Online would have a potential user. (highly likely with our logo staring them in the face every time they click their mouse)

A Forbes Online Banking survey found that 75 percent of online banking respondents pay bills directly at vendor websites and other third party payment services instead of at their own bank, and “customers who pay bills online are more satisfied than those who don’t, providing banks an opportunity to increase satisfaction and loyalty by converting online bankers to online bill payers. The report can be accessed below:

http://pdf.forbes.com/adinfo/OnlineBankingSurvey2005.pdf

Therefore, the bank's online banking system would become both more profitable and secure and simultaneously create a more loyal banking customer. Pay By Touch would benefit by utilizing this distribution strategy which provides a client (the bank) who is ripe for cross selling other PBT services, i.e. our credit card processing services via our Agent Bank Program. Sounds "win-win-win" to me.

The Underbanked “are” Banked, they're just not Online yet…

In the trade-rags I read, everyone is so excited about going after the “unbanked” marketplace. The unbanked are virtually useless to us in this application because we need people who have a checking/debit or credit account. So let’s identify a different type of customer, one I'll call the "under" banked consumer...the one with a checking and or debit account, however, the one that does not use online banking.

Having identified the "under" banked market as “offline banking” customers” PBT can help the banking institution "convert" these customers into "online" banking customers with the same previously aforementioned PBT biometric mouse offer. On the surface, it seems like an ideal conversion device.

Having identified the "under" banked market as “offline banking” customers” PBT can help the banking institution "convert" these customers into "online" banking customers with the same previously aforementioned PBT biometric mouse offer. On the surface, it seems like an ideal conversion device.

There are 65 million under banked customers and by working with the banks, we have the potential ability to convert a lot of them into online banking customers. It appears to be a viable marketplace.

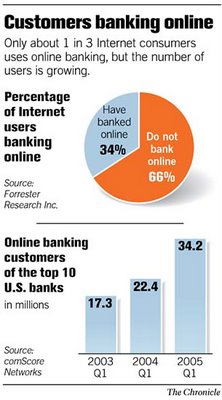

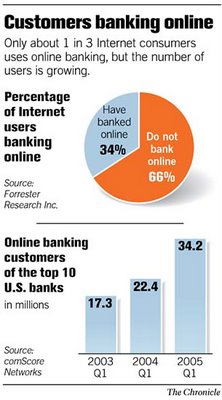

Look at the growth and numbers of online banking customers in the chart on the left. It's an exciting high growth market and Pay By Touch is in possession of a compelling product that can provide a safer environment for a bank's online banking platform. A strong market is in it's early stages of evolution... existing bank customers who are not yet banking online.

We can target market bank's with the aforementioned benefits and once we procure a distribution agreement, their banking members become our captive market. It also creates an opportunity to cross-sell our card processing and check cashing programs, thus enhancing both of those divisions.

If 34.2 million people bank online and 66% do not, that leaves a 65.8 million under banked and thus, a hugely untapped target market. I believe that banks will align with us because it really is a turn-key promotion with enough built-in benefits to all parties to make the proposition enthralling.

Consider this from SFGate:

Online-banking customers are valuable catches. They rack up comparatively lower transaction costs for banks in part because they typically make fewer trips to branches and place fewer calls to call centers. They eliminate paper waste and postage costs by viewing account statements and canceled checks online, banks and researchers said. – SFGate.com

“This year, for the first time in 10 years, the volume of online banking transactions processed by us -- 1.5 billion per year and climbing -- has surpassed ATM, phone and teller transactions combined, said Sanjay Gupta, a top e-commerce executive with Bank of America

Banks would save, thus earn “lot” of money by converting their unbanked “offline” into “online” banking customers. It's always easier (and cheaper) to “keep customers you have” than to get them back “after they leave.” (ask AT&T) And we would help them procure millions of “more loyal” enrollees and at the same time procure potentially millions of PBT Online users. (Which will, in turn, attract the top Internet Retailers to do business with us as well)

Loyalty from online banking customers outperforms offline-banking customers by 40%. Therefore, to increase loyalty, you go after the offliners. Pay by Touch can be of significant value in doing that and banks can be of significant value to spur enrollment.

More About Banks and Bill Payments

Online Banking and Bill Payment are two of the fastest growing applications on the Internet, yet banks face significant challenges to achieving widespread adoption of the Web channel and to maintaining ownership of the online bill payment relationship.

“For banks, the key message is that there is tremendous payoff for encouraging their customers to pay bills at the bank site. The more bills customers pay on their bank’s website, the more satisfied they are and the more likely they are to purchase more products and services from their bank online or in a branch,” said Larry Freed, an online satisfaction expert and head of ForeSee Results.

“Adopting the bank’s web channel does not necessarily decrease customers’ use of other channels, however, it does make customers more loyal, more likely to increase share of wallet and more inclined to recommend their bank’s website to their friends, neighbors and colleagues.”

http://www.foreseeresults.com/Press_OnlineBanking.html

With that said, the potential for this program seems infinitely better than the route of selling $30 sensors in a retail outlet or from the PBT website.

Yesterday, Digital Transactions Magazine suggested that Pay by Touch “may face a hurdle when it comes to getting consumers to acquire and hook up finger scanners. It says “consumer adoption of peripheral devices has lagged with other authentication and payment programs.”

Today, IT Week in the UK said: Pay By Touch, has launched an online version of its fingerprint reading service. However, there is a need for an external device, the fingerprint reader- which could be a barrierto-adoption.

And Internet Retailer reported today that: “To use the online service, consumers must purchase a finger sensor from the Pay By Touch web site or from Pay By Touch partners, such as Internet merchants and financial institutions", says Jon Siegal, executive vice president of Pay by Touch Online. "Finger sensors will cost less than $30". Editor's Note: (inserted October 4th, 2007) Anybody still wonder why he's gone...

Although I agree that consumer adoption of peripheral devices has lagged, (as there are many documented examples), I would suggest that the reason it happens is because; in those cases, there was a requirement for an “additional” peripheral device. An additional device requires an available USB port, which sometimes people don’t have available. It also requires installation and additional space on the desktop. These requirements will diminish adoption levels. As you know, people purchase items because they “want” them or, to a lesser extent, because they “need” them.

If a PC user could simply replace their existing “older” peripheral device with a “brand new superior” device the adoption hurdles may well be alleviated. PBT could therefore; simply offer a higher quality replacement for a device the consumer already has, needs and uses…their mouse.

The PBT biometric “mouse” would not require an additional port, it’s easy to hook up, it doesn’t take up additional desk space, and it will include a biometric sensor for more secure and convenient online banking and online shopping. Now we’ve got a potential recipe for success.

The replacement of anything old with anything new, happens more frequently in the field of technology than anywhere else…especially when advanced features and ease of use are involved. It is a natural psychological fit, because we want the consumer to “replace” the way they currently purchase online with Pay by Touch, not just add PBT as another “optional” payment choice. If it came from a well-known manufacturer, Microsoft for example, then brand association would help with mass adoption. The alternative is providing it on an OEM basis, emblazoned with the PBT logo, resulting in better branding for PBT. Personally, I’d go the OEM/PBT logo route, as it essentially puts our name and logo in front of the user 24/7/365, or every time they use their PC.

The end result is that instead of Pay by Touch selling a finger scanner for $30, we’d be offering a better alternative to their existing mouse. This new bio-mouse would be wanted not only because it’s brand new, but also because it upgrades their existing old peripheral with a new dynamic...a biometric sensor.

A mouse with the PBT biometric sensor would help alleviate fears and provide “peace of mind” by enhancing security when transacting online. It could also be used to securely sign in thus alleviating the need for passwords.

There also exists, a powerful turnkey natural distribution system, with over 34 million+ “captured” customers, and 66 million "captive" users, but more on that in a minute.

A Biometric Mouse could be OEM’d by PBT and distributed via banks to secure and procure online banking customers and create PBT enrollees. What if Pay by Touch (via a distributor) offered to make this upgraded more technologically advanced, biometric mouse, available for “FREE”? What? Did I just say the “F” word? Yes, I apologize but hear me out; I’m trying to drive adoption here.

This may sound like it would be capital intensive but it isn't. There is a very cost effective, and resourceful way for Pay by Touch to accomplish this.

First: Identify the target market. I’m suggesting it is the online banking customer. Currently there are 35 million (and growing) online banking consumers, most of whom have concerns regarding online security. Biometrics can appease those concerns.

Second: Identify the target distribution method. Obviously, it is their banks because that's who consumers already with their money. Consumers are more apt to follow the suggestion of a trusted source and banks are that “trusted source.”

Potential Problem: Usually distributors need to have some sales acumen, and banks aren't known for that.

Potential Problem Solved: Banks overcome this disadvantage because they already have established, inherent trust. Two of the most important goals in sales are to establish trust and overcome the unspoken objection.

The unspoken objection when you give away something free, is: “There must be a catch” and “There's no such thing as a free lunch.”

Banks however, naturally overcome that objection because they have been giving away things for free since the beginning of time. It's the only way they know how to sell. Instead of toasters, microwaves, radios, etc., why not a free Pay by Touch Biometric Mouse when their existing customer signs up for their new improved, more secure online banking program.

The task at hand now becomes: How can Pay by Touch convince Banks to become “very enthusiastic” distributors of a device that costs them $30 a pop?

Here’s five ways:

First, point out that the bank would benefit economically by eliminating the IT costs associated with e-mailing “username /password,” reminders or costs associated with resetting them every time there is a suspected breach... a cost that has been estimated to average around $150 annually per user.

Secondly, the bank would surely enhance their image by introducing a whole new “safer” online banking experience/platform amid consumer fears regarding online banking.

Third, there is more loyalty from online banking customers. Forrester Research reports that online banking customers are 40% more likely to stay with their institution.

Fourth, Biometrics from PBT would increase the potential number of that bank's customers who would sign up for their online bill payment as it would be safer and more convenient.

Finally, Pay by Touch could point out that; it would cost the bank essentially nothing and simultaneously provide a tremendous value in return. Here's why it would cost the bank essentially nothing to give these away free.

a: By eliminating a user that costs $150 per year and replacing them with one that doesn't, the $30 investment results in a $120 return on investment…the first year alone.

b: The bank could write off the cost of the mouse ($30), as an “advertising” expense instead of the $150 as an “operating” expense, and it would be advertising money better spent than normal advertising, because it would target a specific “profitable” niche.

Consequently, the bank’s customers would benefit from increased convenience and peace of mind. PBT could help position the bank to convert the customer into an Online Banking AND Bill Payment user and Pay by Touch Online would have a potential user. (highly likely with our logo staring them in the face every time they click their mouse)

A Forbes Online Banking survey found that 75 percent of online banking respondents pay bills directly at vendor websites and other third party payment services instead of at their own bank, and “customers who pay bills online are more satisfied than those who don’t, providing banks an opportunity to increase satisfaction and loyalty by converting online bankers to online bill payers. The report can be accessed below:

http://pdf.forbes.com/adinfo/OnlineBankingSurvey2005.pdf

Therefore, the bank's online banking system would become both more profitable and secure and simultaneously create a more loyal banking customer. Pay By Touch would benefit by utilizing this distribution strategy which provides a client (the bank) who is ripe for cross selling other PBT services, i.e. our credit card processing services via our Agent Bank Program. Sounds "win-win-win" to me.

The Underbanked “are” Banked, they're just not Online yet…

In the trade-rags I read, everyone is so excited about going after the “unbanked” marketplace. The unbanked are virtually useless to us in this application because we need people who have a checking/debit or credit account. So let’s identify a different type of customer, one I'll call the "under" banked consumer...the one with a checking and or debit account, however, the one that does not use online banking.

Having identified the "under" banked market as “offline banking” customers” PBT can help the banking institution "convert" these customers into "online" banking customers with the same previously aforementioned PBT biometric mouse offer. On the surface, it seems like an ideal conversion device.

Having identified the "under" banked market as “offline banking” customers” PBT can help the banking institution "convert" these customers into "online" banking customers with the same previously aforementioned PBT biometric mouse offer. On the surface, it seems like an ideal conversion device.There are 65 million under banked customers and by working with the banks, we have the potential ability to convert a lot of them into online banking customers. It appears to be a viable marketplace.

Look at the growth and numbers of online banking customers in the chart on the left. It's an exciting high growth market and Pay By Touch is in possession of a compelling product that can provide a safer environment for a bank's online banking platform. A strong market is in it's early stages of evolution... existing bank customers who are not yet banking online.

We can target market bank's with the aforementioned benefits and once we procure a distribution agreement, their banking members become our captive market. It also creates an opportunity to cross-sell our card processing and check cashing programs, thus enhancing both of those divisions.

If 34.2 million people bank online and 66% do not, that leaves a 65.8 million under banked and thus, a hugely untapped target market. I believe that banks will align with us because it really is a turn-key promotion with enough built-in benefits to all parties to make the proposition enthralling.

Consider this from SFGate:

Online-banking customers are valuable catches. They rack up comparatively lower transaction costs for banks in part because they typically make fewer trips to branches and place fewer calls to call centers. They eliminate paper waste and postage costs by viewing account statements and canceled checks online, banks and researchers said. – SFGate.com

“This year, for the first time in 10 years, the volume of online banking transactions processed by us -- 1.5 billion per year and climbing -- has surpassed ATM, phone and teller transactions combined, said Sanjay Gupta, a top e-commerce executive with Bank of America

Banks would save, thus earn “lot” of money by converting their unbanked “offline” into “online” banking customers. It's always easier (and cheaper) to “keep customers you have” than to get them back “after they leave.” (ask AT&T) And we would help them procure millions of “more loyal” enrollees and at the same time procure potentially millions of PBT Online users. (Which will, in turn, attract the top Internet Retailers to do business with us as well)

Loyalty from online banking customers outperforms offline-banking customers by 40%. Therefore, to increase loyalty, you go after the offliners. Pay by Touch can be of significant value in doing that and banks can be of significant value to spur enrollment.

More About Banks and Bill Payments

Online Banking and Bill Payment are two of the fastest growing applications on the Internet, yet banks face significant challenges to achieving widespread adoption of the Web channel and to maintaining ownership of the online bill payment relationship.

“For banks, the key message is that there is tremendous payoff for encouraging their customers to pay bills at the bank site. The more bills customers pay on their bank’s website, the more satisfied they are and the more likely they are to purchase more products and services from their bank online or in a branch,” said Larry Freed, an online satisfaction expert and head of ForeSee Results.

“Adopting the bank’s web channel does not necessarily decrease customers’ use of other channels, however, it does make customers more loyal, more likely to increase share of wallet and more inclined to recommend their bank’s website to their friends, neighbors and colleagues.”

http://www.foreseeresults.com/Press_OnlineBanking.html

With that said, the potential for this program seems infinitely better than the route of selling $30 sensors in a retail outlet or from the PBT website.