It Sure Looks Good on Paper...

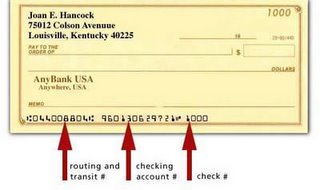

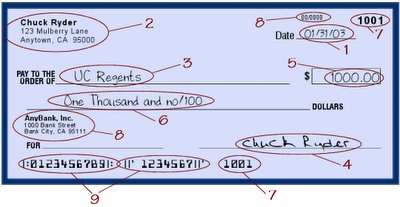

If you were to take a blank piece of paper, and fill it in with all your pertinent personal information, then added your vital financial information you would have created a "paper check". Let's examine why this is a totally "illogical" way to pay. What is the key information that data thieves look for? Take a look at the illustration above and let's analyze the information imprinted (or filled in) on it...

1. Is the account active? The date gives them that info.

2. They'll want a Name, Address, Apt #, City, State and Zip Code

3. They'd love to have a sample of your handwriting

4. A copy of your signature sure would be an added bennie!

5. Don't worry about this one...they'll fit it in later...

6. Even more data on your handwriting style

7. Was a check number already used? Let's jump up 50 spots in line.

8. If only they had the name and address of your bank.

8top. A "Transit number" sure would be nice.

9a. Wouldn't it be a wonderful thing to have a "routing number"

9b. I've got almost everything I need...if only I had a personal account number...

Now...how would a data thief go about obtaining a copy of your check? (and information)

1. They could get a job at a grocery store or as a cashier somewhere...

2. They could pay a minimum wage cashier $25 bucks for every copy of a check they give them.

(of course he might only pay $5 if he gave them a free digital camera cellphone, theirs to keep!)

3. He could hang out at Walmart or Albertson's and buy 10 items (1 at a time) and use his own cell phone to snap pictures of your checks)

Are you starting to get a picture of the inherent risks when it comes to paying by check? The advent of Check 21 in October of 2004, enables retailers to use "check imaging" What's that? A check imager scans your check and takes a "picture" or captures an "image" of your paper check and then sends it "electronically" (where the hackers, phishers and pharmers live)

The point is that checks are simply the most dangerous payment mechanism you could possibly choose to use. Yet "almost" everyone uses them!

In closing, counterfeit checks are the fastest growing source of fraudulent checks. Check counterfeiters use today's sophisticated color copiers to copy stolen checks. Exact imitations of genuine checks can be created with readily available desktop publishing capabilities. Scanning a real check into a computer, and then using desktop publishing software to "cut" the written information and "replace" things like check numbers is easy with existing programs. This form of check fraud has the potential for explosive growth in the near future.

Pay by Touch = No Checks

Your finger is scanned and identifies 40 data points out of over 1000.

It's not a fingerprint, it's not a finger image. It's a finger scan. The cashier scans the groceries...you scan your finger.These data points are then converted into an algorithm, and because there's over 900 data points missing, even if the data was hacked, it could not be reverse engineered to get into your financial data. To make it even more secure, Pay by Touch uses your 7 digit phone number as a PIN. This serves as a double authentication and also to find your 40 data points faster. (out of the millions on IBM's secure server)

The whole transaction takes less than 10 seconds. So, you have to ask yourself...if new information equals new decision would you...

Pay by Check or Pay by Touch?The most secure way to pay today is biometrics.

No Financial Data is available to the eye.. (If Defense is "D" then biometrics is "Eye D"

No Financial Data is available to the eye.. (If Defense is "D" then biometrics is "Eye D"So why do these so-called "privacy" advocates want you to avoid biometrics when it "protects your privacy"?

Analogy of the Day:

If someone was using Food Stamps or EBT cards, and was self-conscious about being on welfare, they may be embarassed to pull out their Food Stamps (check) or their EBT Card (debit) for all to see?

On the other hand, if they enrolled their EBT card with Pay by Touch lwould anyone know how they were paying? Would anyone know they were on welfare? No. Therefore biometrics PROTECT privacy.