Frequently Asked Questions

Frequently Asked QuestionsWhat is PIN-Debit?

PIN-Debit is the card your bank issued to you, usually with a checking account, that you use to withdraw cash from ATMs or in conjunction with purchases at the point-of-sale. It is also known as an "ATM card" or "debit card". PIN-Debit is one of the most secure forms of payment because the Personal Identification Number (PIN) is known only to you and providing or entering it when making a transaction proves that it is you using your debit card.

What is my PIN?

Your PIN is a four- or six-digit Personal Identification Number that is issued to you by your bank, or selected by you either during or after receiving a card. Your PIN is a secret number that is known only to you. Since it is known only to you, and is very difficult to guess (it could take thousands of tries to guess a 4-digit PIN, and most systems would suspend the account or alert the account-holder after 3 unsuccessful tries) the PIN offers substantive protection with a minimum of effort or inconvenience.

As a rule, you should never share your PIN number with anyone else-even family members. You should never put your PIN into an email or letter or respond to anyone asking you for it. If you feel that someone else might know your PIN, you should work with your bank or credit union to get it changed at your earliest convenience.

What is Internet PIN-Debit?

ATM Direct delivers a suite of highly sophisticated security mechanisms to protect the PIN, identify the user and input device and ensure the uniqueness of the transaction. These mechanisms enable you to make purchases at participating e-commerce merchants in a safe, secure and completely private manner. You can now purchase on the Internet using PIN-Debit just like you can at many brick-and-mortar stores.

In fact, because he PIN provides assurance that it is you using your card and no one else, it is safer than any other type of transaction and helps prevent fraud.

How does PIN-Debit protect me?

When you correctly enter your PIN during a purchase at a participating online merchant, you confirm that you are the authorized cardholder and associated both with the device interacting with the merchant's website and the transaction for which a payment authorization is being requested. The PIN is entered into a secure, constantly-moving PINpad window and passed to ATM Direct for verification (called authentication). Once authenticated, the request for payment authorization is relayed via the Electronic Funds Transfer networks (e.g., STAR, Pulse, NYCE, Accel/Exchange to the card issuer for a check and hold on funds for the amount requested. If an incorrect PIN is entered for the card account by the user, the purchase will not be completed (and the user will be directed to try another method of payment..

How secure is Internet PIN-debit?

Internet PIN-Debit by ATM Direct meets or exceeds industry standards for security for PIN-Debit processing. ATM Direct has been audited and certified by EFT networks and by third-party EFT security experts. ATM Direct uses the most advanced authentication, encryption and security technologies in the industry to secure your computer, transaction and account.

Why should I use Internet PIN-Debit?

Many online shoppers are uncomfortable using their signature-based credit and debit cards online because-after all-signatures were made for face-to-face use in physical locations. Still other consumers don't have access to these cards or sufficient credit lines, to shop with them online. But most consumers know that PIN-secured debit cards are the safest means of transacting. So Internet PIN-Debit provides extra protection for you for when you are shopping online. No one knows your PIN but you!

Internet PIN-Debit is just as easy as using your PIN-debit card at a brick-and-mortar retail store such as your local supermarket or drugstore. The only difference is that Internet PIN-debit can be used at participating online e-commerce merchants. So consumers now have the ability to control on a pay-as-you-go basis the use and timing of when their funds can effect a purchase; no bills or interest charges down the road, no surprise NSFs (from overdrawing from accounts with signature-debit cards) and

Will I need to apply for a new card or PIN to use Internet PIN-debit?

No, Internet PIN-Debit uses the bank-issued debit-card and PIN you already have.

I am not a computer expert. How easy is it to use Internet PIN-Debit?

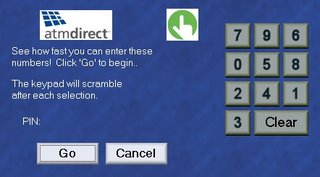

Internet PIN-Debit is quick and easy to use. Nothing changes on the merchant's online store site or the merchant's purchase process. When you go through checkout at a participating online store, and present a valid Debit or ATM card our Internet PIN-Debit PIN-pad will activate to allow you to securely select your PIN number.

Internet PIN-Debit is quick and easy to use. Nothing changes on the merchant's online store site or the merchant's purchase process. When you go through checkout at a participating online store, and present a valid Debit or ATM card our Internet PIN-Debit PIN-pad will activate to allow you to securely select your PIN number.The process secures your personal computer and then display’s a PINpad. This PINpad "floats" around the PC or mobile device screen, and presents the numbers in a randomized order for each of the four digits entered, using your mouse to click on the correct digits, instead of your keyboard. This mechanism frustrates most malware programs, such as "keyboard sniffers" or viruses that try to steal private information such as log-in credentials. Once you have entered your PIN (usually 4 digits) and selected "Continue" in the accompanying box, your information is securely sent to us (and not the merchant). We request an authorization from the issuer of the card, and that decision is passed back to the merchant.

Can I get a separate card and PIN for everyone in my family or can I get a special card and PIN for the Internet if I want to?

Sure, just contact any participating bank or credit union. You can find out whether your bank or credit union participates either on the ATM Direct or participating Electronic Funds Transfer network (e.g., STAR, Pulse, NYCE, Accel/Exchange, etc.) websites, your financial institution's website, or by just entering in your 16-digit Primary Account Number (PAN) after clicking the ATM Debit payment method option. If your current FI is not participating, please let them know you would like your card enabled for Internet PIN-debit!

Can I use Internet PIN-debit from any computer?

You can use Internet PIN-Debit from any of your personal computers if the browser supports 128-bit encryption. This may be at home, at work or on your lap-top when you travel. We do not allow Internet PIN-debit from public computers. You should never enter any personal information, bank account information or credit card information on a public personal computer that you do not know whether it is secure or not.

We use special software to be sure that your computer is secure and safe to use. Once you download our software and personalize your PIN-pad, you simply shop as you usually do. We do not use pop-ups so you can still use your existing anti-virus, firewall and pop-up blockers like you always do. We only support personal computers running Microsoft Windows at this time.

Can I use more than one debit card?

Yes, you can use any or all of your debit cards with their PINs as long as the bank or credit union that issued them is participating in Internet PIN-Debit. There are no additional steps to take to use additional cards.

I have a pop-up blocker on my computer. Will Internet PIN-debit still work for me?

Yes, Internet PIN-Debit is not affected by pop-up blockers.

I have a virus checker with a firewall installed. Will Internet PIN-debit still work for me?

Yes, but you are likely to get a notice the first time the software accesses the internet, simply "Grant" access to insure successful operation.

How can I change my PIN?

Contact your bank or credit union; they issued your card and have the facilities to change a PIN.

When will the money be taken out of my account?

Most financial institutions put a hold on and/or take the money out of your account immediately. In some cases, funds may be taken out later that same day.

What if I do not have enough money in my account?

If your transaction is declined from your bank for insufficient funds, the merchant will give you an opportunity to use another account or card to complete the transaction.

Are there any minimum and maximum payment amounts?

These floors and ceilings are set by the financial institution that issues your card..

Security Alert - E-mail hoaxes, Phishing and Pharming

Fraudsters use a variety of techniques to collect banking account information from consumers. You should always be on your guard against fraudulent emails and websites that might ask you for confidential information like your card and PIN number.

We will never contact you via email and ask you to supply us with any financial data like your credit card details, or your PIN. If you think you've received a fraudulent email, or directed to a fraudulent website, please let us know, forward the details to phishing@ATMDirect.com

I'm concerned I may have provided my personal details on a hoax e-mail, what should I do?

Call your bank or credit union immediately. Check your statements carefully for any fraudulent activity on your card, and report any suspicious activity as soon as possible to your bank or credit union.

How do you change or update my software?

If we need to update our software on your machine, we will automatically update it the next time you use it.

How much does it cost me to get it and to use it?

Internet PIN-Debit costs you, the consumer, nothing to obtain and use this software. It's free!

If I have additional questions about Internet PIN-Debit, who can I contact?

Please contact us at Info@ATMDirect.com .