Rich Smith of Motley Fool weighs in with his analysis of MasterCard's IPO and prospects.

Rich Smith of Motley Fool weighs in with his analysis of MasterCard's IPO and prospects....favorite quote from this article: "unless, of course, you're still using a checkbook -- which is, like, so 20th century."

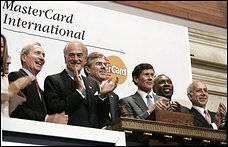

MasterCard (NYSE: MA), the world's second-largest credit card brand, has joined No. 3 American Express (NYSE: AXP) on the public markets. Thursday, MasterCard became the second-largest IPO ever, floating 61.5 million shares on the New York Stock Exchange at an offering price of $39. Why $39? IPO lead managers Goldman Sachs (NYSE: GS), Citigroup (NYSE: C), JPMorgan Chase (NYSE: JPM), and HSBC (NYSE: HBC) lowballed the offering price at the 11th hour, dropping it from its expected $40 to $43 range to give the new stock some room to "pop."

And pop it did. As of this writing, MasterCard shares are changing hands at $45 and change. The 15% rise in price isn't just a function of the IPO handlers' fiddling, however. MasterCard is arguably one of the best kinds of investments to own, and it's little wonder that investors are clamoring for a piece of the company.

Here's why

Forty years old and still growing strong, MasterCard rules one-third of the triumvirate of card payment systems through which trillions of dollars of purchases flow every year. For convenience-loving consumers who would rather their pockets not jingle-jangle-jingle as they do their holiday shopping, credit card operators like MasterCard act as "tollbooths." These are the kinds of businesses that master investor Warren Buffett, to name one, loves to invest in himself -- legalized monopolies that get to sit around and collect a fee for everything that happens on their watch. You want to buy that Tiffany pendant? Think that pink flamingo would add just the right touch to your front yard? Then you have to pay the piper, and if not in cash and coin, then in plastic (unless, of course, you're still using a checkbook -- which is, like, so 20th century).

And how much do you pay? In a recent statement on the European Union's ongoing investigation into the "outrageous" profits of MasterCard and its brethren, European Competition Commissioner Neelie Kroes estimated the size of the European credit market at $1.6 trillion. Here in the U.S., the Federal Reserve says we funneled $2.3 trillion in payments through card providers in 2004. According to Kroes, credit card systems like MasterCard are taking an average of 2.5% of those massive capital flows as their "cut" for facilitating the payment process. For its part, MasterCard claimed a total of $1.7 trillion worth of those capital flows in 2005, amounting to a little less than one-third of total "gross dollar volume" charged to cards worldwide.

So clearly, this is a great business to own. But to steal a line from Bob Barker: Is the price right?That's the $64,000 question, isn't it? Unfortunately, although it's patently obvious that MasterCard, the business, is a great investment, it's not easy for the individual investor to get a good read on whether MasterCard, the stock, is priced to move. With the IPO just hours old, the major providers of financial data don't yet have up-to-date metrics posted for the stock, which would help investors decide whether MasterCard, the stock, is right for their portfolios.

Fortunately, "The Motley Fool is investors writing for investors." And because the MasterCard offering is one that I've developed an interest in, that's just what I'm going to do in the next few paragraphs. So let's get to it.

Here's what we know. MasterCard sold 61.5 million Class A shares on Thursday, and with the offering already looking successful, it's likely the underwriters will exercise their overallotment option and bring the total number of shares issued to 66.1 million. According to the firm's 424(b)(4) filing with the Securities and Exchange Commission, the 61.5 million Class A shares will constitute 46% of the firm's total equity (and 83% of total voting rights). Once the overallotment is exercised (or after a follow-on offering takes place, in the unlikely event that the overallotment is not exercised), the 66.1 million shares outstanding will constitute 49% of equity (and 83% of voting rights).

Before you pull out your calculators and get to figuring a value for the company as a whole, though, let me share the good news that MasterCard made calculating its market cap a breeze by reserving 13.5 million of its Class A shares for donation to The MasterCard Foundation, a private charitable foundation incorporated in Canada. According to the SEC filing, these 13.5 million shares constitute an even 10% of equity. Multiply 13.5 million by 10 to figure out the total equity and you've got 135 million shares outstanding after the IPO. (As for the remaining shares, 60 million Class B shares will still be owned by MasterCard's "principal members," its customers.)

Thus, what we're looking at now is a firm valued at $6.1 billion based on 135 million total shares trading for $44 each. Or that is the value that will be assigned to it once the various financial data providers get a handle on all the math, which should happen in a day or so.

Now we've got something to work withSo let's get to figuring some ratios, shall we?

P/EAccording to the Fool's data provider, Capital IQ, MasterCard earned $300.2 million in net profits over the last four quarters. Divide $5.9 billion by that and you've got the firm trading at a trailing P/E of a little more than 20.

Cash profitsFor those who are less than enthralled with accounting profits, we can also figure the firm's cash profits, or free cash flow. Over the last four quarters, MasterCard generated $327.7 million in operating cash flow. Subtract from that its $43.3 million in capital expenditures and you're left with $284.3 million in trailing free cash flow.

Enterprise value At last report, MasterCard had $1.3 billion in cash and equivalents and short-term marketable securities on its balance sheet. It also had $230 million in long-term debt. Subtract the latter from the former, then subtract the result from the firm's market cap, and this business is valued at:

$6.1 billion - $1.3 billion + $0.2 billion = $5 billion in enterprise value.

EV/FCFWhich accordingly lets us put the firm's enterprise value-to-free cash flow ratio at roughly 18. GrowthReferring back to Capital IQ, I see that over the last five years (using the firm's fiscal 2005 numbers as a starting point), MasterCard has grown its revenue at a compounded rate of 15% per annum, and its net profits at 18%. More recently, however, growth has been slowing. For example, year over year, revenue grew only 13% against fiscal 2004 and profits were up only 12%.

Free cash flow has been pretty lumpy over the last five years, doubling from 2001 to 2002, halving from 2002 to 2003, tripling from 2003 to 2004, and falling 27% from 2004 to 2005. Overall, however, the trend has been for free cash flow to compound at a bit less than the rate of revenue growth: roughly 14% per annum.

Foolish takeaway

So here, for what it's worth, is my initial take on MasterCard: Based on both historical profits growth and historical free cash flow growth, the stock looks overvalued, but not egregiously so. Divide the company's 20 P/E by the 18% growth rate at which the company has been compounding net profits over the last five years and MasterCard looks almost perfectly valued at a PEG of 1.1. Divide its 18 EV/FCF by the 14% rate of free cash flow growth, and the result is a nearly identical 1.3 ratio.

So at today's price, is the stock a steal? No. But is it fairly priced? Pretty much, yeah, especially if MasterCard can continue growing its free cash flow and accounting profits at least at historical levels. Personally, between its superb business model, the ever-growing credit card market, and the stock's reasonable price, I'd have no hesitation buying MasterCard at today's levels.

Not so fast, Rich. According to the Fool's ironclad disclosure policy, you cannot buy shares in any company you've written about, until you've first waited 10 days. Rules is rules, you know. Fool contributor Rich Smith does not own shares of MasterCard as of the time of publication, and won't be owning them for at least 10 days more. JPMorgan Chase is an Income Investor recommendation.